Real estate crowdfunding makes property investments accessible to a broader range of investors, making real estate investing much simpler with lower minimum investments and reduced reliance on traditional mortgage lenders. Now more than ever it is easier than ever before to expand your financial portfolio through this form of investment.

However, it’s essential to remain wary of overly optimistic projections and understand that returns could vary over time. Furthermore, diversifying investments is essential for mitigating risk.

Investing in Real Estate

Real estate crowdfunding provides investors with an exciting way to diversify their portfolios with properties they would not normally have access to. Through crowdfunding platforms, investors can invest in both residential and commercial real estate projects.

Investors usually purchase shares in a special purpose vehicle that owns the property they’re investing in, which helps protect their funds from being misused by companies operating real estate crowdfunding platforms, thus mitigating risk for investors.

As with any real estate investment, returns from crowdfunded real estate projects depend on local market conditions and economic variables that influence property values and profitability.

Investors should seek to identify crowdfunding platforms with robust security measures, a customer service hotline and educational resources to help them understand both risks and benefits associated with crowdfunding. They should also be informed of any minimum investment amount requirements or accreditation needs when selecting their crowdfunding platform for property investment needs. By doing this, they can make an informed decision when selecting their crowdfunding platform of choice.

Investing Through a Platform

Real estate investment offers attractive diversification benefits for portfolio diversification. Unfortunately, direct ownership can be prohibitively costly for those with limited capital; that is where real estate crowdfunding comes in handy.

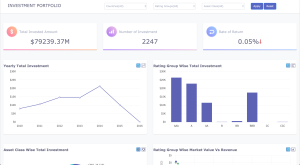

Crowdfunding platforms enable investors to pool capital from multiple sources and invest in residential and commercial real estate through various investment vehicles such as development projects or partial ownership of existing holdings – either individually or together.

Real estate crowdfunding platforms conduct extensive due diligence on properties before listing them, which involves an examination of titles, finances and other relevant factors. Investors can access this report through their online dashboards; furthermore they receive regular updates regarding rental incomes, occupancy rates and other indicators which could impact returns. While real estate crowdfunding platforms take every precaution possible to protect investors, market fluctuations can still impact returns; it is wise to be wary of overly optimistic projections and consider diversifying portfolios accordingly.

Choosing a Platform

Step one in investing through real estate crowdfunding involves selecting an appropriate platform. These platforms provide access to curated lists of property investment opportunities suitable for individual budgets, preferences, and risk appetites.

Real estate investments often take time to turn a profit and require investors to remain committed for at least several years or possibly decades, due to being inherently illiquid and difficult to convert to cash quickly.

Crowdfunding platforms typically enlist the services of experienced real estate professionals to oversee day-to-day operations, property management, and strategic decisions related to their underlying properties. Investors will typically have limited control over these investments due to extensive transaction fees associated with selling or transferring them – this may present difficulties when trying to minimize exposure to illiquid assets and generate passive income streams. A financial advisor can assist in reviewing all available options to find one which might work better for you.

Choosing a Property

Real estate investing can be an excellent way to diversify your portfolio, but it is crucial that you conduct thorough research and consult an investment adviser before making your decision.

Platforms offering these opportunities also conduct extensive vetting processes to give investors access to deals not readily available through more traditional real estate investing techniques. Furthermore, these platforms may offer lower minimum investment requirements so investors can “dip their toe” in with limited capital outlay.

Investors should be mindful that real estate investments tend to be illiquid and may be difficult to sell quickly in times of economic instability. Real estate investments tend to be longer-term commitments ranging from several years up to decade or more; making them less liquid than stocks and bonds and creating liquidity issues for some investors.