Let’s be honest. For most of us, the idea of owning a rare vintage car, a piece of a multi-million dollar commercial building, or a share of a famous painting feels like a fantasy. It’s the kind of thing you see in movies, reserved for the ultra-wealthy with private bankers on speed dial. Well, not anymore.

The game is changing. Fractional ownership is dismantling those old, exclusive gates and inviting a new generation of investors inside. It’s like getting a slice of the most exclusive cake in the world, without having to buy the whole, impossibly expensive dessert.

So, What Exactly Is Fractional Ownership?

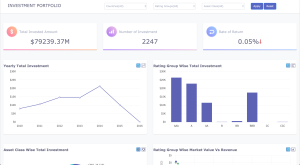

In simple terms, fractional ownership is when multiple people pool their capital to collectively own a single asset. Each investor holds a “fraction” or a share, represented by tokens or digital shares. You own a piece of the pie, and you get a proportional slice of any potential profits—whether that’s from rental income, appreciation, or a future sale.

Think of it like a timeshare, but for serious investments. Instead of just one week a year in a condo, you own a tangible piece of an asset with real financial upside. It democratizes access. Suddenly, asset classes that were once completely out of reach are now… well, within your portfolio’s reach.

Beyond Stocks and Bonds: The Allure of Alternative Assets

Why would you even want to own a fraction of a racehorse? Good question. The answer lies in diversification. Traditional portfolios are heavy on stocks and bonds, which is fine, but they’re also heavily correlated. When the market dips, your entire portfolio often feels it.

Alternative assets—things like real estate, fine art, collectibles, and venture capital—often march to the beat of their own drum. Their performance isn’t always tied to the S&P 500. This can smooth out your investment returns and provide a hedge against market volatility. It’s about not having all your eggs in one basket, even if a few of those eggs are now, say, a rare whiskey cask.

The New Frontier: Popular Fractional Asset Classes

The range of assets you can own a piece of is expanding rapidly. Here’s a look at the main players:

- Real Estate: This is the big one. You can own a share of an apartment building, a warehouse, or even a sprawling farm. Platforms handle the property management, tenants, and maintenance, so you’re a passive landlord.

- Fine Art & Collectibles: Ever wanted to own a Picasso? Or maybe a rare, mint-condition comic book? Fractional platforms acquire these blue-chip assets and issue shares. You get the bragging rights and the potential for appreciation.

- Aviation & Marine: Private jets and yachts are massive investments with massive upkeep costs. Fractional ownership spreads the purchase price and the ongoing expenses across a group, making it a viable (and luxurious) investment.

- Venture Capital & Startups: Getting into early-stage startups was once a club for Silicon Valley insiders. Now, you can invest small amounts in a portfolio of promising new companies.

- Collectible Cars & Watches: Classic cars have historically outperformed many traditional assets. Fractional ownership lets you tap into that market without needing a garage the size of an airplane hangar.

The Good, The Bad, and The Illiquid

It sounds almost too good to be true, right? And, well, like any investment, it comes with its own set of pros and cons. You need to know both sides of the coin.

The Upside: Why It’s So Compelling

First, the good stuff. The benefits are genuinely transformative for the average investor.

| Benefit | What It Means For You |

| Lower Barrier to Entry | You can start with a few hundred or thousand dollars, not millions. |

| Instant Diversification | You can spread your investment across multiple assets and classes, reducing risk. |

| Professional Management | The platform handles all the complex, hands-on stuff. You just invest. |

| Access to High-Performance Assets | You get exposure to assets with strong historical returns that were previously inaccessible. |

The Downside: The Risks You Can’t Ignore

Now, let’s talk about the risks. This is crucial.

- Liquidity (or the lack thereof): This is the big one. You can’t just click a button and sell your share of an office building at 3 PM on a Tuesday. These markets are not like the stock market. There’s often a holding period, and selling your share might take time and come with fees.

- Platform Risk: You are placing a huge amount of trust in the fractional ownership platform itself. They are the legal owner of the asset. If the platform goes under or is poorly managed, your investment could be in jeopardy. Do your due diligence on the company.

- Fees: While lower than buying the whole asset yourself, there are still fees. These can include acquisition fees, management fees, and performance fees. They eat into your returns, so read the fine print.

- Complex Valuation: How do you accurately value a one-of-a-kind painting or a vintage car? It’s not an exact science. The value is ultimately what someone is willing to pay for it, which can be subjective and volatile.

Is Fractional Ownership Right for Your Portfolio?

So, should you jump in? Honestly, it depends. Fractional ownership in alternative assets isn’t a replacement for your core investment strategy. It’s a supplement. A powerful, exciting one, but a supplement nonetheless.

Think of it as the satellite part of a “core and satellite” portfolio strategy. Your core is your stable, diversified foundation of stocks and bonds. The satellites are your higher-risk, higher-potential plays—and that’s where fractional alternatives can shine.

It’s best suited for capital you can afford to lock away for the medium to long term. Don’t invest your emergency fund. Don’t bet the farm. But if you have some discretionary capital and a desire to truly diversify, it’s a modern tool that deserves a look.

The Final Word: A Democratized Future

The world of investing is undergoing a quiet revolution. The velvet ropes are coming down. Fractional ownership is more than a financial product; it’s a shift in philosophy. It acknowledges that value and opportunity shouldn’t be hoarded by a select few.

It empowers you to build a portfolio that is genuinely unique, that tells a story, and that isn’t solely at the mercy of Wall Street’s mood swings. Sure, it’s not without its complexities. But for the curious, the forward-thinking investor, it opens up a world of tangible, fascinating possibilities. The only question left is, which piece of the world do you want to own?